MIDDLE EAST AND NORTH AFRICA • FINANCIAL SERVICES

Philip Bahoshy

JULY 19, 2017

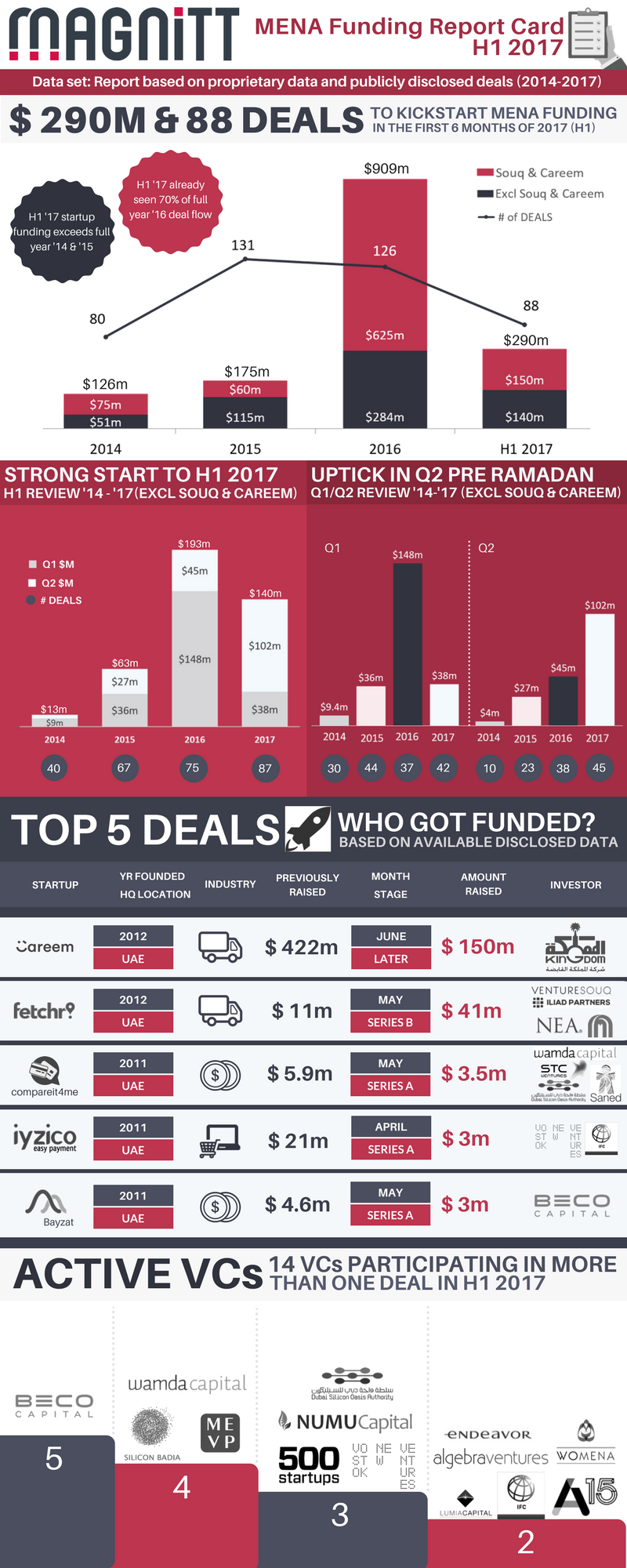

MAGNiTT’s MENA funding report card reveals a pick up in Q2 investments: $290m invested in 88 disclosed deals across the region in the first six months of the year!

(Dubai, United Arab Emirates) July 19th, 2017 – With transparency at the core of MAGNiTT’s values, today it publishes their follow up to the Q1 funding report card with an update overviewing the first six months of the MENA funding landscape. It’s report highlights positive news for Entrepreneurs and Investors alike with a solid start to 2017. In the first six months of this year they identified 88 disclosed deals amounting to $290m in startup funding.

Key takeaways from MAGNiTT’s H1 report card include:

MAGNiTT’s founder, Philip Bahoshy, states “this is positive news all around for Entrepreneurs and Investors showing a healthy appetite for investment in MENA startups”. He also notes “ There is generally a lag in reporting of startup funding because of confidentiality concerns and time to close deals and I expect there to be a further flurry of activity after the summer”. These positive signs highlight a growing and healthy ecosystem with continued room for improvement.

This report looked to provide additional information to further empower stakeholders to make decisions on how best to further boost and develop the startup ecosystem across the region. The MAGNiTT founder also highlighted that they continue to build relationships with VCs and startups to gather the most comprehensive data set of startups but that transparency of information remains an issue for the region with regards to data reporting.

Bahoshy notes “there was a flurry of activity leading up to Ramadan and the summer”. As noted in their previous report VC are investing to close out existing funds while simultaneously looking to close new funds which will no doubt create continued momentum into Q3 after the summer.

In conclusion, the latest report card shows continued funding in the MENA region and raises further awareness and transparency on the MENA regions funding environment. A strong start to the region sets it up to match if not exceed 2016 numbers. All data of investments on startups are available on www.magnitt.com where you are able to track funding history as well as portfolios of the regional VCs.

MAGNiTT, founded by Philip Bahoshy, is the largest online community platform for startups across the MENA region. Based out of Dubai, UAE, MAGNiTT connects entrepreneurs directly with ecosystem stakeholders including funders, mentors, support services, and talent. Startups can apply for funding directly to VCs and angel networks from MAGNiTT. Investors, Corporates, Mentors and Service providers are able to review information on over 3,500 startups including their funding history. MAGNiTT is also an established provider of data and analytical reporting for the MENA startup ecosystem.

For more information, interview requests and high resolution images contact [email protected]

For more information about MAGNiTT http://www.magnitt.com

Follow MAGNiTT on social media on Facebook, Twitter, Linkedin and Instagram

Philip Bahoshy is the founder and CEO of MAGNiTT, an online community that connects MENA entrepreneurs with stakeholders across the MENA ecosystem. Raised in the UK with Iraqi origins, Philip obtained an MBA from INSEAD in 2013 and a BSc in Economics from the London School of Economics. During his time in Dubai, Philip worked at Oliver Wyman in the Financial Services practice for three years, followed by nearly three years at Barclays Wealth working as Chief of Staff to the CEO advising on strategic initiatives. Philip has lived in the UAE for more than eight years and is passionate about developing the MENA startup ecosystem.

“Disclaimer: Seedstars encourages freedom of speech and the expression of diverse views. The views of columnists published on Seedstars are therefore their own and do not necessarily represent the views of Seedstars.”